Spring Real Estate Awakening, Mastering Your Mindset, and What's an AVM, why is it FREE? and Rates!

Tuesday Tips for Realtors: 03/25/2025

In a rush? Watch the cliff notes here:

Top Story:

Spring Awakening: How the 2025 Housing Market is Heating Up Early

As we continue through 2025, the real estate landscape is waking up from its slumber, with Texas playing a pivotal role in shaping national trends. That's how we do things here in Texas!

Understanding and monitoring these shifts is crucial for making informed decisions whether you're a seasoned Realtor or a first-year Rookie!

National Trends

Moderate Price Growth

After years of rapid appreciation, home prices are expected to grow more moderately across the U.S. in 2025. This shift toward a more balanced market will offer buyers better negotiating power and more time to consider their options.

Interest Rates and Buyer Activity

Stable and lowering interest rates are boosting buyer activity a little early this year, especially among first-time homebuyers and those moving from higher-cost states. This trend is stimulating the housing market, particularly in regions with strong job markets.

Sustainability in Real Estate

There's a growing emphasis on sustainable building practices in real estate, with developers prioritizing green building certifications and renewable energy integration. This shift benefits the environment and enhances property values over time.

Speaking of going green, save your clients money with the team at Anchor Energy. Whether it's solar or just finding a better energy bill, Anchor Energy will show you the green! (Shout out only - great team - no compensation. )

Texas Market Spotlight

Texas remains a hotbed for real estate activity, driven by our strong economy and continued population growth. Here are some key trends to focus on:

Population Growth and Housing Demand

Texas continues its rapid population growth, driving up housing demand. This week I have heard stories from multiple agents about multiple offers submitted same day, one day on the market, and offers submitted site unseen. It's getting hot, folks!

Urbanization and Technological Advances

The ongoing urbanization trend and technological advancements are transforming the Texas real estate industry. Mixed-use developments and smart home technology are becoming increasingly popular, influencing buyers in a strong way.

Commercial Real Estate Boom

Cities like Dallas-Fort Worth, Houston, and Austin are experiencing significant commercial real estate activity. Dallas, in particular, has been ranked as a top market for investment and development in 2025, thanks to its resilient economy and strong demand.

Rental Market Strength

Despite increased supply, the rental market in Texas remains robust, driven by ongoing job and population growth. Cities like around Texas are seeing high rental yields, making them attractive to investors.

Regional Variations in Texas

While Texas as a whole is experiencing strong growth, different regions have unique trends:

Dallas-Fort Worth: Known for its booming tech industry, DFW is a prime spot for real estate investment, with a median property price of over $676,000 and a rental yield of about 5%.

Houston: With a strong job market in energy and healthcare, Houston offers high rental yields and a competitive entry point for investors.

Arlington: Located strategically between Dallas and Fort Worth, Arlington offers a stable real estate market with a high rental yield and strong job opportunities.

Continue to see what happens!

This year, the real estate market is always poised for a mix of challenges and opportunities. The key to success is staying informed and optimistic about the evolving landscape. By networking with other real estate professionals and dedicating time to market insights, you can make better decisions and capitalize on the opportunities that arise for your client base.

Read on:

Texas Real Estate Research Center: 2025 Texas Real Estate Forecast

What's My Cash Flow: Top Texas Markets for Real Estate Investment

Top Growth Tip:

Mastering Your Mindset

This week, I was reminded about the importance of mindset. As a real estate professional, your most valuable asset isn't your client list or market knowledge—it's your mindset.

The last few years have been tough, and every time I meet an agent who started in the last two years, I am reminded of how much opportunity is still out in the market, even when the market news is all doom and gloom. How did these new agents survive? Maintaining a positive, resilient, and growth-oriented mindset is the difference between merely surviving and truly thriving in this competitive industry.

Cultivating the right mindset is essential. View every challenge as an opportunity to learn and grow rather than just another reason to quit. Too often, we look at others through envious eyes, thinking these pitfalls ONLY happen to us.

GARBAGE! I could use other words, but I'm trying to keep this reader-friendly 😉

Every pitfall is a lesson. Keep in mind that the lesson may not be profound or super clear. Your lesson may be as simple as testing your grit.

Do you have what it takes to do it again? How much rejection can you take?

Sounds like fun, uh? Well, it is if you think about it in these terms:

Practice makes permanent.

You may have been in school, a stay-at-home parent, a barista, or in the corporate world as recently as 6 months or 6 years ago. Whatever your story, every interaction with someone is an opportunity to practice a skill of your craft. There may be only four main types of buyer personalities in sales, but in our world clients bring all thier quorks and backstories along for the real estate ride.

The take away here is, you must give yourself every at bat, with every person possible to become damn good at what you do.

But wait, this was about mindset?

Exactly. To put yourself in as many situations as possible to become good at what you do will take a lot, and I mean A LOT of rejection. Maybe you are on a good run right now, but what goes up must come down. It’s a law of life. So when it come,s if you instill some healthy practices in your life, it will be that much easier to navigate those tough times.

So how do you deal with all that rejection? Like this:

Morning Affirmations: Right when you open your eyes, start telling yourself positive things. If you don’t know what to say, say, “I will have a good day.”

You never let your friends and family talk badly about themselves. Don’t you dare do the same to yourself.

Journaling: Hit up the dollar store and buy a journal. Put the date, and just write. When you're done or your hand cramps because you never write with pen anymore, sign your name. That simple. This time is for you to throw up on paper, mentally, free of judgment. Empty that brain of the thoughts bouncing around.

Create a vision board: I personally keep mine on my desktop. I used a free site I heard about years ago called Visionboard.cc. Make it on your laptop or tablet, save it, and keep it wherever you will see it to remind you of why you are on the path you are on.

Walk: You can hit the gym or do workout videos, but walking is the best. Walking comes with fresh air and sunlight. Walking re-energizes you so you can keep going on with your day. It is the most underrated activity.

Listen to whatever you want, but to improve your game, focus on real estate podcasts or motivational music. It's a bit jock-ish, but I love listening to Fearless Motivation, and they seem to be on most music apps.

End the day with Funny: A few years back, as a VP of Underwriting for a national lender, I had to terminate over 200 people within 1 year. It messed with my head, heart, and, sadly, my family. But after the first couple layoffs, I remembered something a sales coach told me a few years back:

Before bed, always watch something funny. No more than 15-20 minutes; just make sure it makes you laugh. I hate scrolling on social media, so I picked to watch either a few moments of my favorite comics or my favorite shows like Brooklyn 99 or The Office. As long as you laugh, waking up the next day is so much easier!

The lesson is always to be aware of your mindset. You don’t need a vacation or an Instagram life to reset. You need 5 minutes. Maybe 30 at first, but in time, you will be able to flip a switch and make your mind right.

Top Lending Tip:

Automated Valuation Model (AVM)

With the market heating up, I have been sending out more and more Property Value Reports to agents.

But it is clear with some agents, they couldn’t remember what an AVM is when I described it. Cannot say I blame them. Real estate has so many acronyms. So I figured I would break it down and show how these reports from your lenders (like me) can help you negotiate on your buy side or validate your value on your listing.

What AVMs show you:

Uses computer algorithms and statistical modeling to create values and forecasts for a property.

Uses mass databases of information and transaction history to support its data.

A range of values for the property, with an estimated figure.

Think like Kelly Blue book for car values, but for homes. They give a value, then a high end and low end of where the value could be based on visual inspection.

A possible figure that lenders may use in the loan QC process.

Several lenders use these reports to confirm the value appraiser give. Sometimes they only use them certain products or loan sizes, they are used a lot in lending to validate the value on the appraisal is not too high and not too low.

AVMs are NOT Comparative Market Analysis (CMA)

They lack boots on the ground analysis like a:

Recent comparables in the direct area

Various upgrades, or lack of upgrades a computer can’t see based on data

You would only see the overall property condition in person.

Real-world trends like multiple offers, concession ranges, etc.

You should have access to these reports just like any other tool you use on a day-to-day basis. So I am offering these to you for FREE. As many as you need for your clients.

No catch: I don’t even need to be the lender on the transaction. Email me a property address at BOgilvie@IgniteLoanPartners.com.

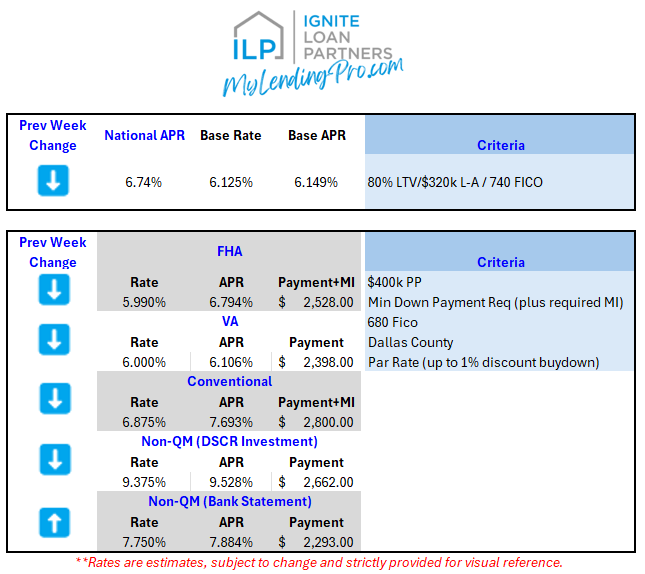

Quick Rate Reference guide for 3/18/2025: ⬇️

The following rate are for visuals to help you see where rates are. These are never final and are intended to be a more realistic look than what you find advertised on popular sites. All rates are subject to client scenarios and are subject to change. Thank you for using common sense when reviewing! 😊

Rates are relaxing a bit more for the everyday consumer! You know people with mid-600 FICO and minimal down payment. That is who these rates are for.

Rates are expected to ease up a bit more in the next quarter or two but continue to encourage your clients to buy now if they are interested.

Low rates = more demand = higher prices.

You would much rather be in a home you want vs only the one you can afford. So buy today, date your mortgage, and refinance it later when the time is right!

Thank you for reading. If you want to have an open conversation about anything related to your business, schedule a time on the calendar, and let’s talk!

If you enjoyed this article and think someone may benefit from this weekly publication, click below!