Watch The Highlights Here: 🔭

If you want to dive more into mortgages, visit my live Webinar this Thursday!

Top Story:

See the Difference - The Rise of VR to Tour Properties

*I decided to take a break from politics and tariffs, enjoy this mix of info!

Virtual reality (VR) and augmented reality (AR) may seem like a futuristic way of doing business, but if you have shopped on Amazon at all, you probably have been tempted to use the AR feature to see how that new lamp will look on your desk. These works are no longer just buzzwords- they’re currently growing in popularity to revolutionize how we buy, sell, and experience real estate. In 2025, these immersive technologies are giving buyers, sellers, and agents new tools to make property tours more efficient, engaging, and accessible than ever before. Leaning into this technology may give you more opportunities to meet serious buyers than you did before.

How are VR and AR Transforming Real Estate?

The traditional home showing involves coordinating schedules, driving across town, and rushing through showings to hopefully meet clients when they say they want to meet. Now, this process could be quickly replaced by digital-first types of experiences. VR platforms like PropVR are leading the way by offering impressive, interactive 3D walk-throughs that let buyers explore every corner of a property from anywhere with an internet connection. These aren’t just simple video tours; they’re immersive experiences where users can “walk” room to room, zoom in on details, and even customize finishes or furniture to see how a space could look.

AR, meanwhile, overlays digital information onto the real world. With a smartphone or tablet, buyers can point their device at a property and instantly see additional information, renovation possibilities, or even visualize how their own furniture would fit. This blend of digital and physical worlds is helping buyers make more informed decisions faster than ever. You can visually show buyers their own renovation suggestions (paint colors, moving walls, etc.) or even virtually stage a home to match the buyer’s style without having to do any heavy lifting.

The Benefits of Virtual Tours

Virtual tours offer a host of advantages for agents and their clients:

Convenience: Buyers can tour properties at any time, from any location- no need to coordinate schedules or travel long distances.

Expanded Reach: Out-of-town or international buyers can view homes remotely, opening up the market to a global audience.

In-Depth Exploration: Unlike static photos, VR tours let users move at their own pace, inspect details and neighborhoods up close, and revisit spaces as often as they like.

Visualization: Buyers can envision living in the space, experiment with layouts, and even see how future renovations would look without the cost of physical staging or unsure updates.

Cost & Time Savings: Sellers and agents save time on repeated in-person showings, and developers can market unfinished or pre-construction properties using digital models instead of expensive physical staging.

The Impact: Faster Sales, Higher Engagement

The numbers speak for themselves. Listings with virtual tours receive up to 400% more inquiries and see a 50% increase in lead conversions compared to traditional listings. Properties with immersive visuals also tend to sell up to three weeks faster. During the pandemic, some developers reported closing major deals entirely through VR tours, even with international buyers who never set foot in the property.

Looking ahead, VR and AR are only going to become more sophisticated and accessible. Whether you’re working with local buyers or international investors, these technologies can help you showcase properties in ways that were unimaginable just a few years ago.

More to Explore:

Top Growth Tip:

Seal the Deal - Negotiating Tactics on the Rise For Spring 2025

As the spring 2025 real estate season unfolds, both buyers and sellers are navigating a market that looks markedly different from recent years. Everyone is dealing with higher-than-desired mortgage rates, elevated home prices, and a rising inventory, which has shifted the balance of power. This combination of market conditions is leading to an uptick in creative negotiations, price discounts, and seller concessions. Not every agent has experience in negotiating in these types of conditions.

I had a client recently who was making lowball offers and high concession figures in a multiple-bid situation. The agent and I both agreed that the client was for sure going to get rejected. Well, guess who now owns a home on their terms? It blew our minds; it was approved, but it goes to show that not much is really off the table in today’s market.

A New Era of Negotiation

Nationally, with inventory at a five-year high and buyer demand cooling compared to previous years, sellers are being forced to get creative to attract offers. According to Redfin, 44.4% of home sellers in the first quarter of 2025 provided concessions to buyers, up from 39.3% a year ago and just shy of the all-time high set in early 2023.

This trend isn’t isolated to Texas; it’s happening all over. In Seattle, a staggering 71% of sellers offered concessions, nearly double the rate from last year. Other areas, such as Portland, Los Angeles, and Houston, are also seeing significant increases.

Creative Tactics Gaining Popularity

1. Strategic Price Reductions

Instead of dramatic price cuts, sellers are opting for targeted reductions after a property has been on the market for a set period. This shows seller flexibility without devaluing the home upfront. According to recent data, 16.8% of homes had price reductions last month, up from 14.6% the previous year.

2. Escalation Clauses and Flexible Terms

On the buyer side, escalation clauses (offering to outbid competing offers by a set amount) and requests for flexible move-in dates are becoming more common. Sellers, eager to close, are often accommodating these requests to seal the deal.

3. Seller Concessions and Contributions

Seller concessions are at the forefront of today’s negotiations. Instead of taking a ego hit on sales price, sellers can give up net proceeds to buyers to entice them to buy their property vs others currently available on the market. These can include:

Repair Allowances: Rather than fixing issues before closing, sellers offer credits so buyers can handle repairs themselves.

Rate Buydowns: Sellers contribute funds to lower the buyer’s mortgage interest rate for the first few years, helping to offset high current rates.

Closing Cost Credits: Sellers pay a portion of the buyer’s closing costs, making the purchase more affordable.

Here is a breakdown of max seller contributions (Non-QM loans typically follow conventional rules:

As inventory continues to rise and economic uncertainty persists, expect creative negotiations and seller contributions to remain a common feature in the market. For agents and clients alike, adaptability and a willingness to think outside the box will be key to successful transactions in 2025. Lean on each other and your lenders to think creatively about how to win more deals.

Read On:

Top Lending Tip:

Serve the Veteran

This section is going to be a slight vent session for me.

Recently, I was in a real estate agent class hosted by a local lender. This lender discussed how much VA volume he handles, mentioning that he had a very unique certification from the VA as a loan originator that most originators do not have, and rattled off “guidelines” to the group as if he were an expert.

When it comes to any lender, especially one that advertises VA loans, be sure to do your research and don’t just accept everything we say. It took everything in my power not to stand up and correct him, and tell him that his “certification” from the VA is not a real thing. The VA certifies underwriters and lenders, but they do not have individual loan officer certifications to make you a Specialized VA Loan Officer. Sure, third-party organizations can come up with special designations (similar to all the courses you can take to specialize), but the VA is not the issuing party.

Personally, I am a certified VA Credit and Appraisal Underwriter (and FHA as well) by the VA. And as an Army brat of two military parents, and a former USAA employee for many years, VA loans hold a very soft spot for me, and I take them very seriously.

Now that my vent is over, let’s get on with the lending tip of the week - VA loans! Rapid fire, I'm going to break down various myths and topics you need to be aware of regarding VA loans.

Here we go!

Yes, you can have multiple VA loans.

If a client forecloses on a VA loan, they can likely get another one.

A Veteran and a non-veteran can be on a VA loan together.

If a client says they are a surviving spouse of a Veteran and has a VA Benefits letter, they can likely qualify for a VA loan, even though they are not a Veteran.

VA loans have much better pricing than Conventional loans.

You can finance up to 100% LTV on VA.

Clients can qualify with some lenders as low as a 500 credit score (use discretion when pitching this; not every borrower with a 500 credit score is financially ready for homeownership).

The VA Funding Fee is the VA version of private mortgage insurance, it just isn’t paid month. Sellers can pay this fee as well!

If your Veteran received VA disability, they do not have to pay a VA Funding Fee. For purchases, the rate ranges from 1.5% to 3.3% of the loan amount.

As of March 31st, 2025, Builder IDs are no longer required on VA loans.

VA loans have some quirks when it comes to qualifying. However, they should not take any more time than an FHA or most Conventional loans. If they do, your lender isn’t going it right.

Property-wise, VA loans are very similar to other loans; they have a different process to validate the collateral. As long as there are no health and safety concerns or peeling paint, appraisal reviews for most properties are not much different than other loan products.

VA offers streamline refinances after six payments are made, so if the refinance makes sense, clients can refinance with no income or appraisals in most cases.

The VA supports Veterans so much more than other government entities, such as FHA, Fannie Mae, and Freddie Mac. The VA works with servicers in unique ways to keep Veterans in their home for as long as possible.

Want to find VA Guidelines - Get it straight from the VA - VA Lenders Handbook

I would argue that there is almost no reason why a Veteran should not use their VA loan benefit. Even if they are looking at high-dollar-value homes, there are ways to maximize your VA benefit for these expensive homes.

Veterans deserve so much more than the benefits they are given. The least we can do is make sure Veterans exhaust every benefit available to them, allowing them the most successful path to homeownership as possible.

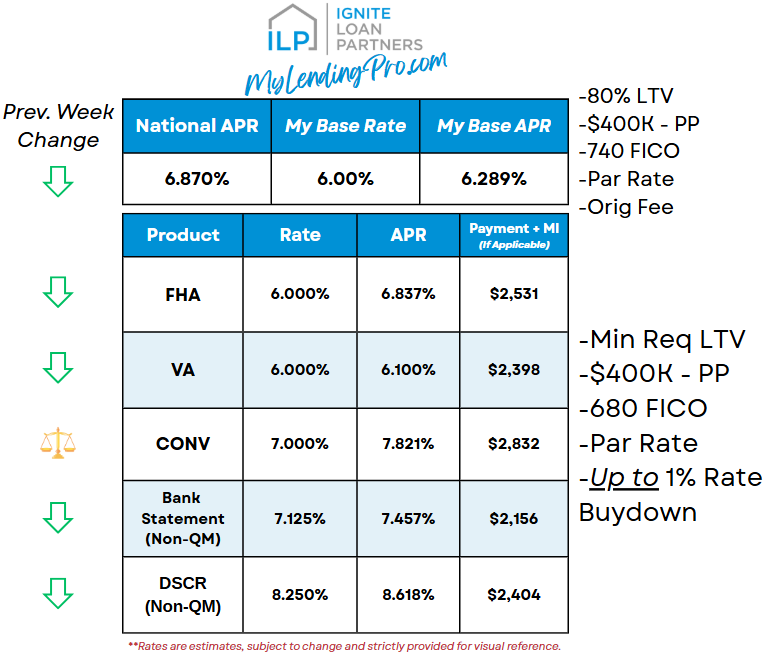

Quick Rate Reference guide for 4/29/2025: ⚖️

The following rates are for visuals to help you see where rates are. These are never final and are intended to be a more realistic look than what you find advertised on popular sites. All rates are subject to client scenarios and are subject to change. Thank you for using common sense when reviewing! 😊

Overview:

Rates overall haven’t moved much.

Except for Bank Statement Loans. These products have dropped pretty drastically - it’s a good time for those with unique income scenarios to qualify!

Overall, rates have trended down and could naturally decrease by about 0.50% if the markets allow. Remember, Wall Street pads the rates to doom prep in case the markets head south.

Outside of headline drama, the next major event to come is the next Fed Meeting on May 6- 7th, which influences the bond markets that back mortgages.