FHA Eligibility Shift, Essential Tasks for Realtors, Secret Buyer Incentive Program, and the Latest on Mortgage Rates: Your Spring Real Estate Update

Tuesday Tips for Realtors: 04/01/2025

Watch the article here: (◉‿◉)

Top Story:

FHA Eligibility Shift - Non-Permanent Residents

Effective May 25, 2025, non-permanent residents will no longer qualify for FHA-insured loans. This change, outlined in HUD’s Mortgagee Letter 2025-09, affects just about every FHA loan option that matters. And

Essentially, borrowers must now meet stricter documentation standards, requiring proof of lawful permanent residency through USCIS-approved documentation.

Implications for You as Realtors:

Lenders may turn off lending for these borrowers earlier than you would expect to limit the risk of FHA Insuring issues post closing. If you have clients who are not fully committed and need FHA, now is the time they need to commit.

Identify clients who may be impacted by this shift and guide them toward alternative financing options such as conventional loans (aka bigger down payment, possibly).

Partner with knowledgeable lenders who can provide solutions for affected buyers. This doesn’t mean they have no options, but their options become limited.

Stay informed on FHA and FHDA updates to advise clients effectively. With any new lending change in one area, other areas (like Fannie/Freddie) could adopt the same rule over time. I'm not saying it will, but it’s possible.

Great Mortgage Read HERE

Continue to proactively adjust strategies to support clients navigating these new restrictions. Again, it’s not the end of lending for these clients—just a change in how we get the job done for them!

Top Growth Tip:

Daily Power List - 5 Critical Tasks

I will never do as good a job as Andy Frisella when it comes to attacking the day. Some of you may find his style not to your flavor. And that is okay—but,

I encourage you to read his article and maybe find the podcast episode and listen to it (that’s a fairly colorful listen for some of you).

The Power List: Critical Tasks

Personal Note:

I learned about this “stupid” simple, yet highly effective approach about 2 years ago. I attempted this when I obtained my first C-Suite position. And I failed at it; feeling like I needed a task list a mile long, I didn’t focus on the right activities, etc.

I recently dusted it off and have been applying it for the last few weeks. Staying focused on just five critical tasks daily has drastically changed the number of conversations I have had. My focus is zeroed in, and my drive is there. Most importantly, when I crush my five tasks, a weight is lifted off my shoulders, and I finish the day with a level of confidence I didn’t have when I started it.

Maybe your goal isn’t to be a top-producing agent. That's cool, but could you imagine what 1-3 more deals a year will do for your lifestyle, your retirement, or even your freedom later in life?

Stay focused on your day, every day.

Top Lending Tip:

The Secret Buyer Incentive Program

This program is established and estimated to last the next 8-10 years. Now, that could change, especially if more and more agents lean on the program. But it is almost a no-brainer if you are buying a home you know you want to keep for the next 5+ years. If your buyer isn’t committing to those plans, I would stay away from the program because it won’t make financial sense at the end of the program.

I personally called my pipeline of fallout preapprovals because they were too concerned they couldn’t afford to get into a home, and this program completely changed their minds!

Incentive Program Benefits Overview:

Financial Incentive: Up to $13,000 towards down payment, closing costs, or paying off debt

Tax Advantage: Up to 30% Federal Tax Credit when using this program.

Ongoing Utility Savings: Long-term, headache-free energy savings

Eligibility Requirements:

Single Family, Primary Homes Only

FHA Loans Only

No additional income, credit, or asset requirements FHA wouldn’t already require.

Education:

Pre-Closing Home Buyer Education Course

Simple Post Closing Financial Mentorship

Eligible just about everywhere except in North & South Dakota, Alabama, Hawaii, and Alaska. But you can tell your friends and family about it in other states!

Did I mention this is also a refinance product for you homeowners reading this?!?

To learn more about this program:

Call: 469-871-5589

Email: BOgilvie@IgniteLoanPartners.com

Put something on your calendar: Good Ol’ Calendly

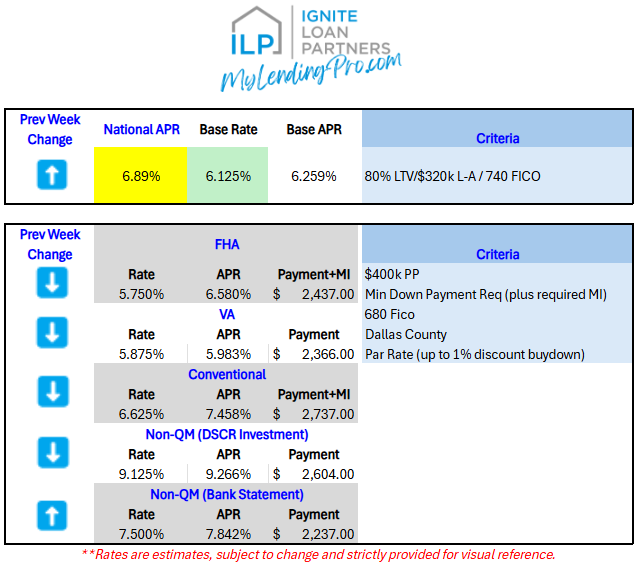

Quick Rate Reference guide for 4/1/2025: ⬇️

The following rates are for visuals to help you see where rates are. These are never final and are intended to be a more realistic look than what you find advertised on popular sites. All rates are subject to client scenarios and are subject to change. Thank you for using common sense when reviewing! 😊

Overview:

Rates and/or APRs decreased - GREAT NEWS FOR BORROWERS!

The costs associated with the rate are basically cheaper

. Example: If 1% buydown got them X.5% before, this week it may get them X.375% or lower. Even if the rate is $20 more affordable now, that could mean a world of difference with the cost of groceries!

What to say to clients who are waiting for lower rates?

Waiting could turn into waiting forever. Rates on any day can go back up and hang out for however long they can.

Thank you for reading.

For those of you who made it this far, email me your thoughts on these weekly updates. I would love to get ideas and hear feedback from you all.

If you want to have an open conversation about anything related to your business, schedule a time on the calendar, and let’s talk!

If you enjoyed this article and think someone may benefit from this weekly publication, click below!